Verification

Complete a quick and easy verification process to gain full access to our platform’s features and trade securely.

KYC Verification Instructions

Know Your Customer (KYC) is a regulatory requirement that obliges financial institutions to verify clients’ identities before processing transactions. This procedure protects both the company and its users from fraud, money laundering, and other illegal activities.

Why is verification needed?

Account verification helps brokers ensure that the client:

- is of legal age;

- has sufficient funds to fund their account; .

- is not involved in illegal activities

How to complete KYC?

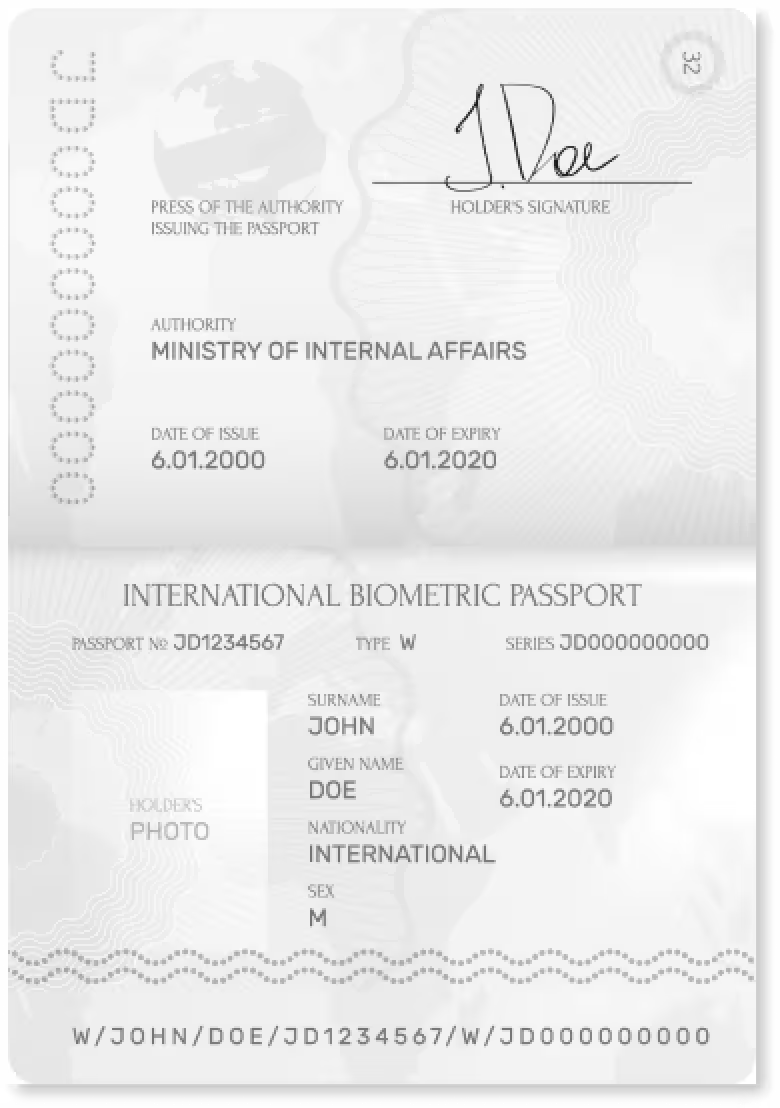

To finish the verification process, provide high-quality scans or photos of identity documents (passport, ID card, or driver’s license). These documents must be uploaded within two days of opening a trading account.

Clients Who Deposited via Bank Card

To complete account verification, you need to provide the following documents:

- Proof of identity

- A valid passport or driver’s license.

- Proof of address

- A utility bill, bank statement, or similar document.

For EU residents: an internet or mobile phone bill issued in your name within the last 3 months is also acceptable. - Bank card photo

- A photo of the bank card used for the deposit (ensure only the first 6 and last 4 digits of the card number are visible).

- Signed declaration form

- A signed declaration form, which you will receive by email from the verification department.

Document Submission Requirements:

- Copy Quality:

Copies must be in color.

All information on the documents must be fully legible. - Image Presentation:

Documents must be scanned as full-page spreads, with all corners and edges clearly visible.

Cropped or partially visible pages are not allowed. - Image Editing:

Images must not contain:

erased elements;

markings;

crossed-out words;

or any other alterations. - Validity and Authenticity:

Documents must be valid at the time of submission.

All required stamps and signatures must be present and clearly visible. - Legibility:

Ensure that documents are clear and easy to read to avoid delays during verification.

Clients Who Deposited via Cryptocurrency

To complete account verification, you need to provide:

- Proof of identity

- A valid passport, national ID card, or driver’s license.

- Additional identity confirmation

- A selfie with the document or another identification method (as requested by the verification department).

Document requirements:

Copies of documents must be in color and fully legible

Document spreads with corners and edges must be fully visible, without cut edges

The image must not contain traces of graphic editing, erased elements, marks, crossed out words or corrections of any other kind

The documents must be valid at the time of the request and have all the necessary stamps and signatures.

In addition, it is important to make sure that all documents are clear and easy to read to avoid delays in the verification process.